Larry Schlesinger, AFR 24/05/21

All states experienced price growth in the farmland sector in 2020. PHOTO: BLOOMBERG

Farmland sales are expected to surge to a record high of more than $5 billion in 2021 as cashed-up farmers expand their holdings and institutional investors ramp up exposure to one of the best-performing real estate sectors. Farmland sales are expected to surge to a record high of more than $5 billion in 2021 as cashed-up farmers expand their holdings and institutional investors ramp up exposure to one of the best-performing real estate sectors underpinned by the increasing demand for food globally.

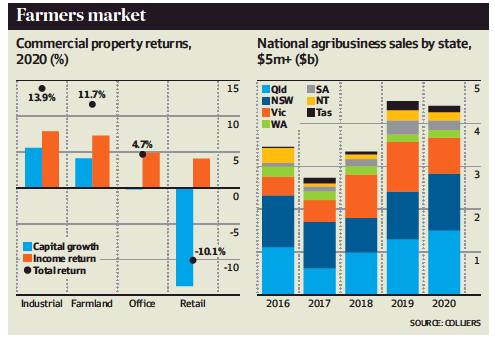

That is the view of rural agents at Colliers whose latest annual Agribusiness Research and Forecast report found total farmland investment (sales above $5 million) reached $4.4 billion in last year, almost matching the $4.5 billion achieved in 2019 despite COVID-19 restrictions and a stricter foreign investment regime making it harder for offshore investors.

Leading the charge for the third consecutive year, was Queensland, which accounted for over a third ($1.5 billion) of farmland deals by value in 2020, followed by NSW, which overtook Victoria after recording $1.3 billion of sales.

‘‘Colliers have the view that farmland sales volumes have the potential to reach a record high in 2021,’’ the firm said in its report.

‘‘Investment competition for high-quality assets is expected to be strong and supported by a variety of investors looking for investment portfolio diversification, and owner-operators looking for vertical integration and economies of scale.’’

Colliers’ head of agribusiness transaction services, Rawdon Briggs, put it more starkly. ‘‘We’re well on track to smash that $4.5 billion figure. We’ll do $5 billion-plus this year,’’ he told The Australian Financial Review.

Mr Briggs said values had climbed about 20 per cent in the past 18 months, a trend highlighted almost every week in the record results achieved for prime farmland across Australia.

In addition, Rural Bank’s Australian Farmland Values 2021 report released last month found the median price per hectare of Australian farmland increased by 12.9 per cent.

Highlighting the resilience of the sector, for the first time in 15 years, all states experienced price growth in 2020, and all but Victoria experienced double-digit price growth on a per hectare basis.

The Colliers report notes that farmland property investments delivered an annualised return of 11.7 per cent in 2020 compared with 4.7 per cent for office towers and negative 10 per cent for malls.

Only the e-commerce-driven industrial property sector delivered a higher return than farmland of 13.9 per cent.

Alex Thamm, head of agribusiness valuation and advisory at Colliers, said the sector’s impressive growth, along with its operational resilience during the pandemic, had made farmland assets ‘‘a very attractive and defensive investment option within diversified portfolios’’.

This attractiveness has been evident in the explosion of new agricultural fund managers that have raised equity to acquire large portfolios of leased assets including Primewest, Stafford Partners and Warrakirri.

This heightened competition from institutional capital is driving up farmland values and compressing yields, two trends noted in the Colliers report.

‘‘We have estimated that agribusiness yields nationally [except cropping and grazing] have fallen to a range of 6 to 7.25 per cent this year compared to a range of 6.25-8 per cent seen in previous years. There is even further compression evident for long term [20+ year] leases to ‘blue chip’ tenants,’’ Mr Thamm said