Packhorse acquires pastoral properties to manage cattle and land under the principles of regenerative agriculture

Four key aspects define the Packhorse investment opportunity:

- Wealth accumulation and capital growth

- Annual income streams

- Participation in positive climate change action

- Carbon and biodiversity credit Income upside potential

Source, Rural Bank 2021

INVESTORS CAN EXPECT

- Target 8-10% per annum returns*

- Carbon and natural capital credit creation

- Capital preservation

- Potential for asset price growth

- (9.5% per annum capital growth in Queensland West for the last 20 years, (source Rural Bank)

- Environmental outcomes at scale

*based on a 10 year investment period

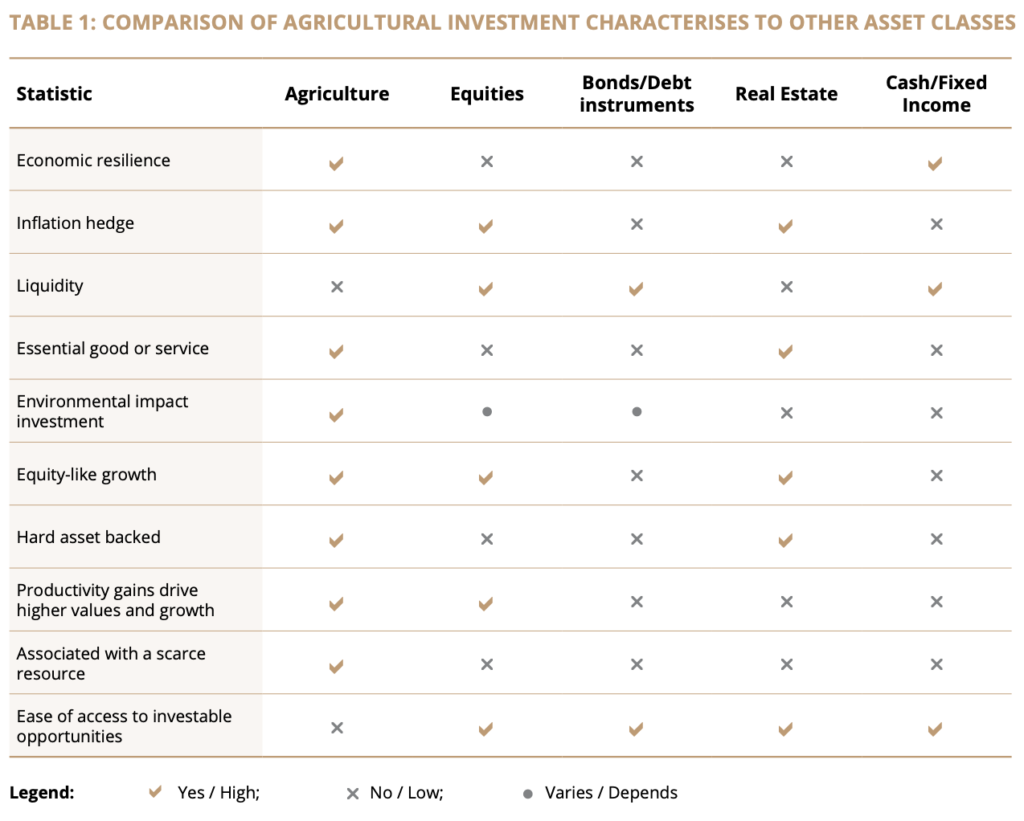

Agricultural land is a strong non correlated asset class

Agricultural land represents a valuable asset class which, when included as a holding in a diversified portfolio, enables the pursuit of long-term return targets at moderate levels of volatility compared to equities and other asset classes. The asset class demonstrates low sensitivity to periods of economic contraction and is an effective hedge against inflation.

- The asset class is a tangible hard asset which is an important driver of capital preservation

- In addition, the value of agricultural land positively correlates to inflation, making it a good hedge against rising inflation

- Agricultural land has proven to be a reliable store of value in times of economic turmoil, including drought, fire and climate change. While financial markets and traditional asset classes have experienced volatility, the impact on Australian farmland values has been minimal

- Over long-term investment horizons, agricultural land has reliably appreciated in value, especially where the productivity and sustainability of operations have been enhanced through effective management practices. As productivity rises, land values increase

The Packhorse Grass Motel provides income stability

Packhorse seeks to complement the capital returns through generating annual income streams based on an “agistment-partnership” revenue model. The Company leverages the Investment Manager’s long established relationships with offtake partners (Customers) to enter into agistment agreements, generating income akin to a Grass Motel.

- A unique pre-negotiated collar / base rent agreement that protects the property by locking in a guaranteed revenue stream to cover the management overheads, regardless of the number of animals agisted on the asset. Base rental is negotiated as a percentage of the acquisition price of the property

- As Packhorse do not own the livestock, we are not exposed to the buy-sell market risk

- The rental (agistment) for the cattle grazing on the asset, is set at a per head rate per week, secured through an agistment agreement (rental agreement) with our Customer. These agreements are generally a 3-year contract, giving both Packhorse and its Customers security and line of sight on expenses.

- Packhorse’s staff is responsible for the upkeep and care of the animals while on property.

The grass motel model allows Packhorse to prioritise the health of the soils by maintaining a minimum level of grass cover while protecting the ecosystem and meeting the environmental objectives.

Packhorse will sequester carbon at scale

To achieve this Packhorse has:

- Engaged market leader CarbonLink, a specialist in the carbon market.

- CarbonLink will deploy their expertise to assist the Investment Manager register eligible projects and record baselines and measure the level of carbon stored in its soils every 3-5 years

- Partnered with Agrimix, The Meat & Livestock Association and Queensland University of Technology to develop and trial innovative technologies to continuously measure carbon levels in soil at a significantly reduced cost compared to currently available methods

- This would enable decreases in the overall cost to deploy carbon projects in 3-5 years time.

Commitments to Net Zero will drive Carbon Unit Prices

Source, Reputex